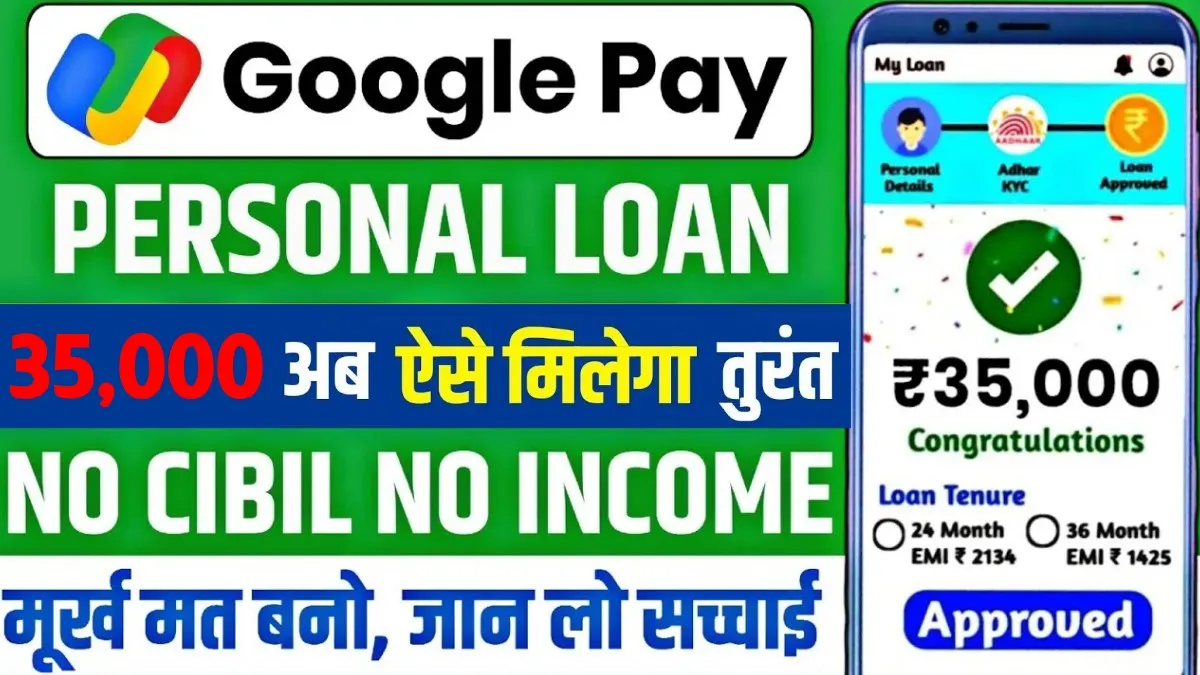

Google Pay Loan: Instant Personal Loan Up to ₹35,000 Made Easy

In today’s fast-paced digital world, having quick access to credit can be a lifesaver during emergencies or unexpected expenses. Google Pay, a widely used digital payments app in India, now offers an easy and convenient way to get instant personal loans up to ₹35,000 through its partnered financial institutions. This service integrates seamlessly within the Google Pay app, providing users with a smooth loan application and disbursal experience.

Table Of Content

What is Google Pay Loan?

Google Pay Loan is a feature that allows eligible users to apply for small personal loans without the hassle of visiting a bank or filling out lengthy paperwork. Through partnerships with multiple NBFCs (Non-Banking Financial Companies) and lenders, Google Pay offers instant loans that can be approved and disbursed quickly within the app. This makes borrowing easy, secure, and accessible for millions of users across India.

Who Can Apply for a Google Pay Loan?

Google Pay loans are generally available to:

- Individuals aged 21 to 50 years.

- Users with a valid Google Pay account who have completed their KYC (Know Your Customer) verification.

- Salaried employees and self-employed professionals with a regular income source.

- Users whose bank accounts and transaction history demonstrate good financial behavior.

Eligibility criteria may vary slightly depending on the lending partner and the user’s credit profile.

Loan Amount and Tenure

- Loan Amount: ₹1,000 to ₹35,000

- Repayment Tenure: 3 months to 12 months

- Interest Rates: Varies from 10% to 24% per annum based on eligibility and lender terms.

The flexible repayment terms allow borrowers to choose a tenure that suits their financial capacity.

How to Apply for a Google Pay Loan?

- Open Google Pay App: Make sure your app is updated to the latest version.

- Find Loan Offers: On the home screen, check for loan offers or visit the “Loans” section.

- Complete Eligibility Check: The app will analyze your profile and bank transactions to assess loan eligibility.

- Select Loan Amount and Tenure: Based on your eligibility, choose an amount up to ₹35,000 and select your preferred repayment period.

- Provide Basic Information: Fill in or verify any additional personal or financial details as requested.

- E-Sign and Submit: Use your Aadhaar-linked mobile number for OTP verification and e-sign the loan agreement digitally.

- Receive Loan Amount: After approval, the loan amount is credited directly to your linked bank account within minutes.

Key Features of Google Pay Loan

- Instant Approval: Many users get loan approval within minutes after applying.

- No Collateral Required: These are unsecured loans, meaning you don’t need to pledge any asset.

- Simple Process: Entire loan application happens within the Google Pay app, no separate app download needed.

- Safe and Secure: Google Pay uses industry-standard encryption and security to protect your data.

- Transparent Charges: All interest rates, processing fees, and repayment terms are clearly displayed before confirmation.

- Flexible Repayment Options: You can repay through Google Pay directly, using UPI or bank transfer.

Charges and Fees

- Processing Fee: Usually between 1% to 3% of the loan amount.

- Interest Rate: Depends on credit score and lender policy, often competitive compared to traditional loans.

- Late Payment Charges: Additional penalties if EMI or full payment is delayed.

- GST: Applicable on processing fees and interest as per government norms.

Always review the loan offer carefully before accepting to avoid surprises. if you need google pay coupon code check allcouponcode

Benefits of Using Google Pay Loan

- Convenience: No need to visit a bank branch; apply anytime, anywhere.

- Quick Money Access: Ideal for urgent expenses like medical bills, travel, or education fees.

- Credit Building: Timely repayment helps build a positive credit history.

- Multiple Lenders: Google Pay connects you with various trusted NBFCs, giving you competitive options.

Conclusion

Google Pay’s personal loan feature offering up to ₹35,000 is a convenient and reliable way to handle short-term financial needs without the complexity of traditional loans. With a simple application process, quick approval, and secure digital platform, it’s a smart choice for salaried individuals and self-employed professionals alike. Remember to borrow responsibly and repay on time to maintain your credit health and continue enjoying such financial benefits in the future.