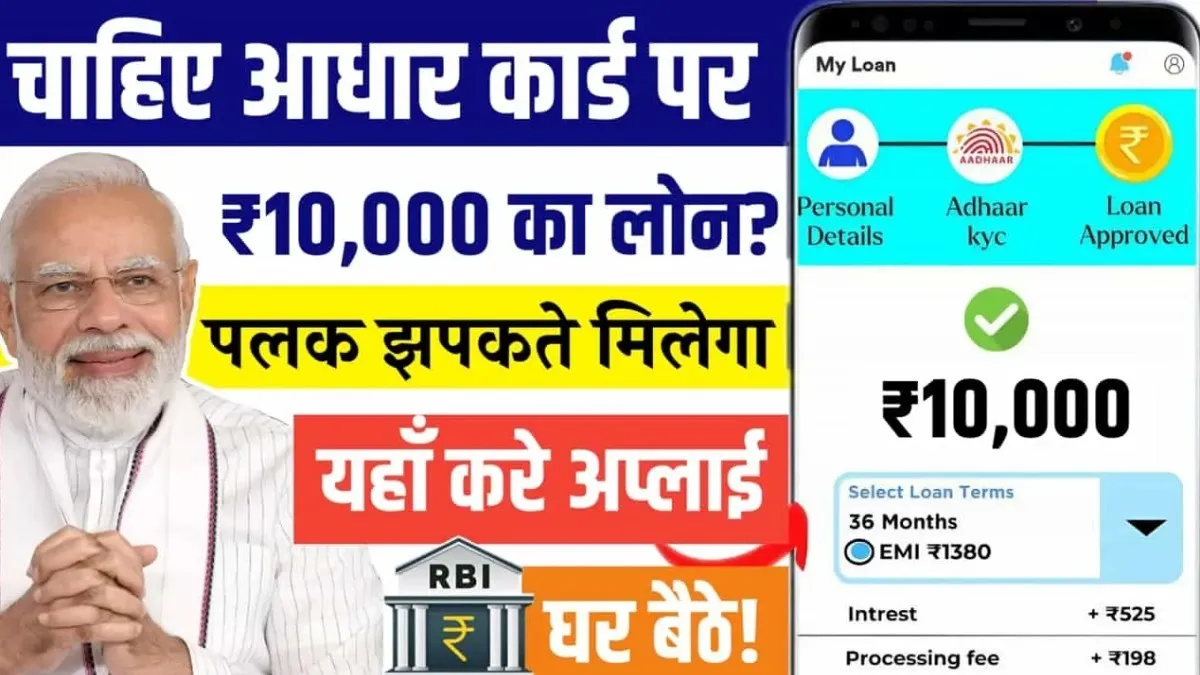

How to Get a ₹10,000 Loan with Your Aadhaar Card: A Simple Guide for Instant Help

In today’s digital world, getting small loans has become much easier, especially if you have your Aadhaar card. Many people across India are now getting quick loans of ₹10,000 using just their Aadhaar number. Whether you need money for an emergency, to pay bills, or handle sudden expenses, a loan backed by your Aadhaar card can help you when you need it most.

Table Of Content

What is an Aadhaar Card Loan?

An Aadhaar card loan is a small personal loan offered by banks, NBFCs (Non-Banking Financial Companies), or online loan apps. These loans are approved based on your Aadhaar card details, which serve as proof of identity and address. The Aadhaar card allows quick verification through e-KYC, meaning you don’t have to submit many documents.

Most Aadhaar-based loans are small-ticket loans, starting from ₹1,000 to ₹50,000. A ₹10,000 loan is one of the most common requests, especially by people who need money for short-term needs.

Why is Aadhaar Important for Loans?

The Aadhaar card is linked to your biometric data, mobile number, and bank account. This connection allows lenders to:

- Verify your identity instantly

- Transfer loan money directly to your bank account

- Communicate through your registered mobile number

- Check your creditworthiness (if linked to PAN and credit score)

Because of these benefits, Aadhaar-based loans are faster and easier to get than traditional loans.

Steps to Apply for a ₹10,000 Loan Using Aadhaar Card

Here’s how you can apply for a ₹10,000 loan using your Aadhaar card:

- Choose a Trusted Loan Provider

Select a reliable loan app, NBFC, or bank that offers Aadhaar-based instant personal loans. Some popular platforms include PaySense, KreditBee, MoneyTap, and CASHe. - Install the Loan App or Visit the Website

Download the app from Google Play Store or visit the provider’s official website. - Complete e-KYC with Aadhaar

Enter your Aadhaar number and complete e-KYC. You’ll receive an OTP on your registered mobile number for verification. - Fill the Loan Application Form

Provide your personal and financial details such as name, occupation, income, and bank account number. - Submit Required Documents

Some lenders may also ask for a PAN card, selfie photo, or proof of income like a bank statement or salary slip along with Aadhaar. - Loan Approval & Disbursal

After checking your eligibility, the lender will approve your ₹10,000 loan. The amount is usually credited to your bank account within 24 hours or even instantly.

Benefits of Aadhaar Card ₹10,000 Loan

- Instant Approval: Faster processing thanks to Aadhaar e-KYC.

- No Collateral Needed: These loans are unsecured; you don’t need to pledge anything.

- Minimal Documents: Aadhaar and PAN are often enough.

- Flexible Repayment: You can repay in EMIs over a few months.

- Accessible to All: Even people with limited credit history can apply.

Who Can Apply for This Loan?

- Indian citizens aged 18 to 60 years

- Must have a valid Aadhaar and PAN card

- A regular income source (salary or business)

- A bank account linked to Aadhaar

- A mobile number registered with Aadhaar

Important Tips Before Applying

- Always borrow from trusted platforms.

- Read the terms and interest rates carefully.

- Repay the loan on time to avoid penalties and improve your credit score.

- Avoid taking loans from unknown or suspicious apps that may charge hidden fees.

Conclusion

A ₹10,000 Aadhaar card loan is a great option if you need urgent cash without going through a lot of paperwork. With just your Aadhaar card and a mobile phone, you can get money directly in your account within hours. These loans are especially helpful for salaried workers, small business owners, and people in rural areas who need fast financial help.

If used wisely and repaid on time, Aadhaar-based loans can help you handle emergencies and build your credit profile for future borrowing.